Banking Finance/Loan Management Solution

Configurable

We have developed Desktop, Client-Server and Cloud deployed software to meet the changing demands of our customers

Security

We build strategies and policies to provide controls to protect data and ERP applications.

Support

We offer our client all-time support to fix any issue and

& permit them to contact our consultants at their time.

Get solutions specific to your domain

Integrated Intelligent Accounting System

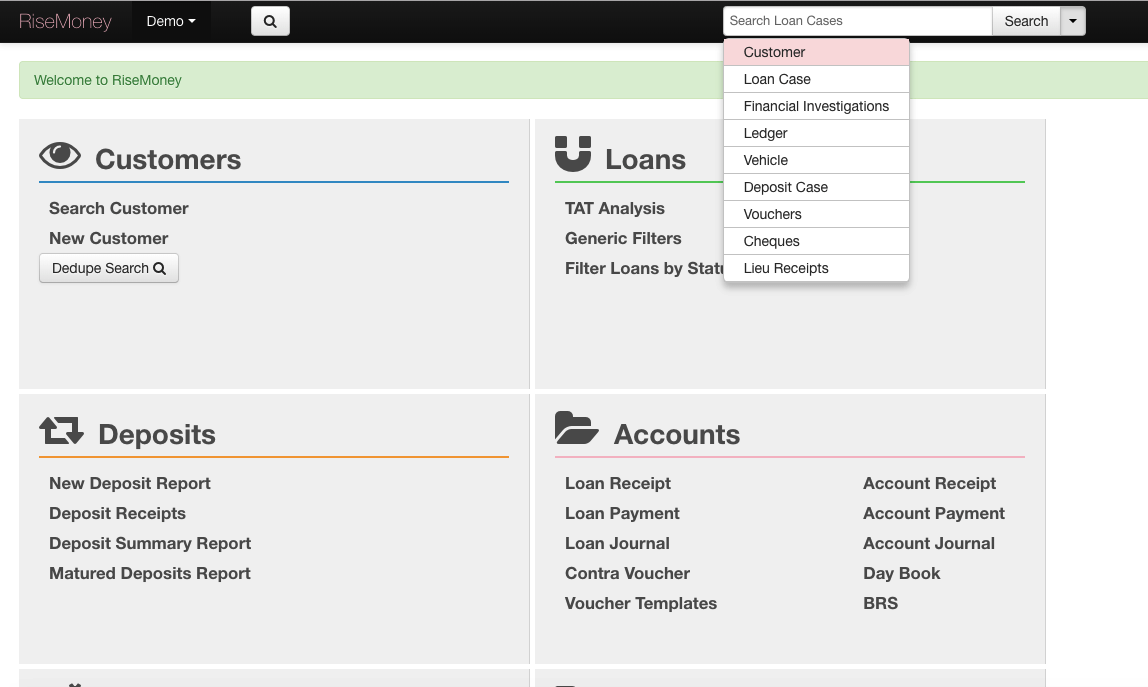

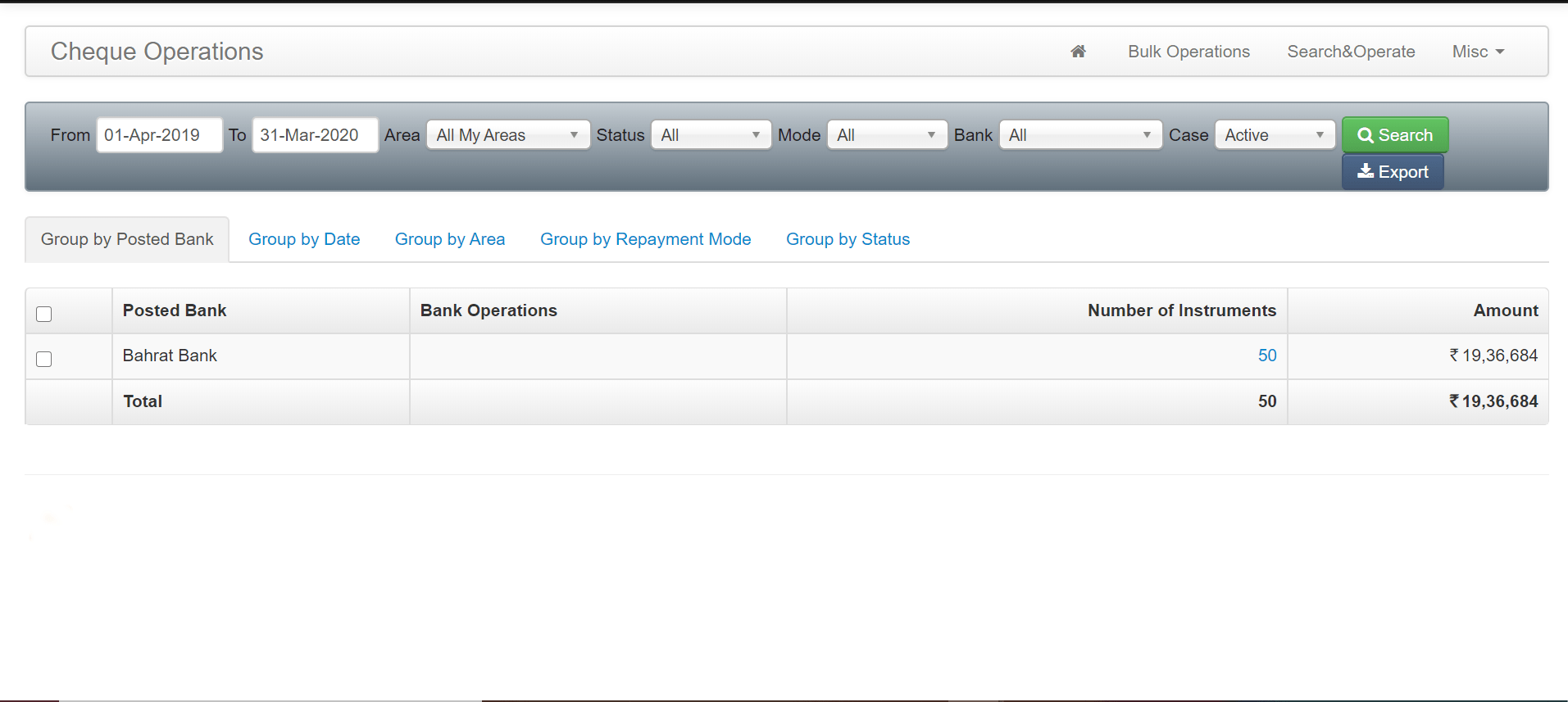

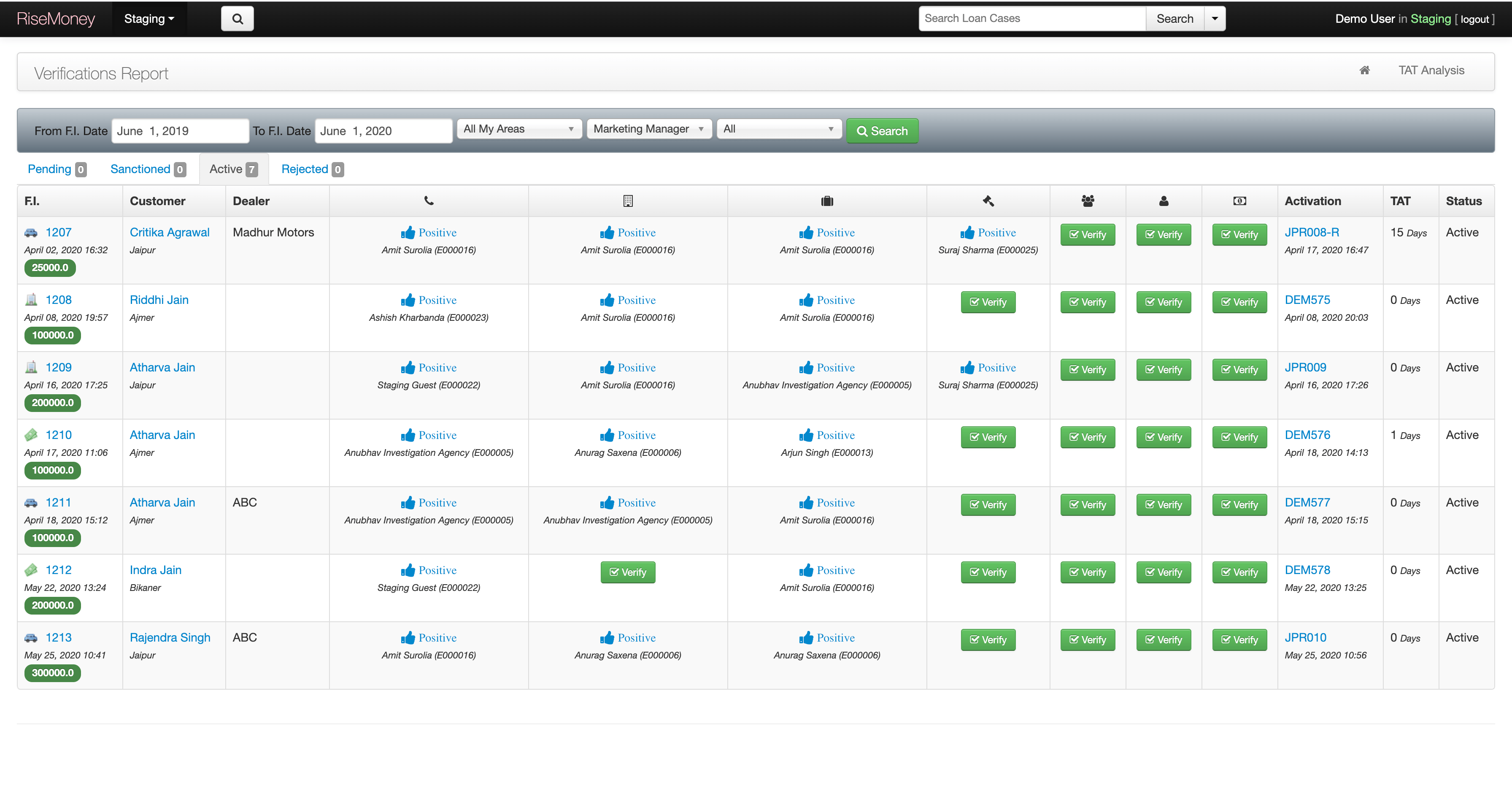

A singular portal for data management that helps access all the information about the

customer like EMI status , payments , dues , deposits , loan case, ledgers and

all financial activities involved across this business domain.

Testimonials

RiseMoney’s ERP solution is a very robust and reliable software and I will happily

recommend it to others.It has been

an able partner in our growth over these years, allowing us to

freely.

Basant Goyal

Since -2010

I am happy

to say that we are extremely satisfied with its performance. I do not recall any significant

down time rather, more locations and products over time and has been able to handle the growing volumes with ease.

Shreyans Kasliwal

Since – 2008